is preschool tuition tax deductible 2019

Sams earned income of 14000 was less than Kates earned income. But this is where things get a little dicey.

Is It Tax Deductible 7 Things Parents Should Know Before They File Parents

However you may qualify for the child and dependent care credit if you sent your child to preschool so you could work.

. These include payments made to any of the following. Of the 2600 they paid 2000 in 2019 and 600 in 2020. Since at least if one or both parents were home while your child attended online preschool sessions then you would not be eligible to claim the child and dependent care credit.

The cost of private school including tuition cannot be deducted. Tuition for preschool and K-12 is a personal expense and cannot be deducted. Educational institutions for the part of the fees that relate to child.

The answer is no but parents can apply for a tax credit if they need childcare in order to work or find work. The loss of this deduction highlights how useful a 529 college savings plan can be for saving money on college expenses. In 2019 Sam and Kate had childcare expenses of 2600 for their 12-year-old child.

Can I Deduct Preschool Tuition On Taxes. HR1994116th Congress 2019-2020 Accessed. Must provide a copy of a current police firefighter EMT or healthcare worker ID to qualify.

If you paid for a babysitter a summer camp or any care provider for a disabled child of any age or a child under the age of 13 you can claim a tax credit. This credit cannot exceed 6000. The deduction for tuition and fees expired on December 31 2020.

Line 21400 was line 214 before tax year 2019. If two or more children are enrolled in preschool you will be eligible for a maximum of 6000. The child care tax credit is available to children who otherwise qualify for child care but who are in nursery school preschool or similar programs.

Day nursery schools and daycare centres. Typically preschool expenses were only counted toward a child and dependent care credit and not a education credit or expense. The Taxpayer Certainty and Disaster Tax Relief Act of 2020 repealed the tuition and fees deduction for tax years beginning after 2020 in exchange for increased income limitations for.

You will not need to itemize the college or tuition fees for this on Schedule A as you might for other fees. The subtraction is limited to 4000 for tuition paid for an elementary pupil and 10000 for a secondary pupil. However taxpayers who paid qualified tuition and fees in 2018 2019 and 2020 could claim a maximum deduction of 4000.

Their adjusted gross income for 2019 was 30000. The credit is limited to a maximum of 3000 per child and 6000 for two or. If youre studying for a qualified degree you could find that youre entitled to the Tuition and Fees DeductionThat means that you can easily reduce your taxable income by up to a rather huge 4000.

Has the tuition and fees deduction been extended to 2021. Nursery school and other prekindergarten costs generally qualify for the Child and Dependent Care Credit because the educational benefits are considered incidental to the child care costs. Information to help determine the child care expenses deduction you can claim.

Preschool and day care are not tax deductible but you can be entitled to credits instead which could mean better. Is preschool tuition deductible. Depending on your income your credit is 20-35 of your childcare expenses up to 3000 or 1050 and 20-35 of childcare expenses up to 6000 or 2100 for two or more kids.

While this tax credit is unlikely to completely cover your childs preschool tuition for tax year 2019 dont miss out on. You can claim child care expenses that were incurred for services provided in 2021. Heres what financial and tax experts want parents of preschoolers to know.

Line 21400 was line 214 before tax year 2019. So is college tuition tax deductible. Parents of incoming Montessori preschool students often ask if their childcare expenses are tax deductible.

What if my child was an elementary and secondary pupil in the same year. No the tuition and fees deduction which you may have used for the 2019 or 2020 tax year has not been extended for the 2021 tax year. Fill in the amount you paid for.

No cash value and void if transferred or where prohibited. Information about Form 8917 Tuition and Fees Deduction including recent updates related forms and instructions on how to file. Please go through the interview for the credit under deductions and credits to see if you qualify for this tax credit.

The IRS allows you to deduct certain childcare expenses on your tax return. Caregivers providing child care services. In theory grandparents can use the education exemption to cover preschool bills too.

Offer valid for returns filed 512020 - 5312020. There are some notable changes with recent legislation. The subtraction is not allowed for amounts paid for private school tuition which were withdrawn from an Edvest or Tomorrows Scholar college savings account.

Valid for an original 2019 personal income tax return for our Tax Pro Go service only. The credit is based on a sliding scale. Form 8917 is used to figure and take the deduction for tuition and fees expenses paid in this tax year.

How Do I Claim The Childcare Element Of Universal Credit Low Incomes Tax Reform Group

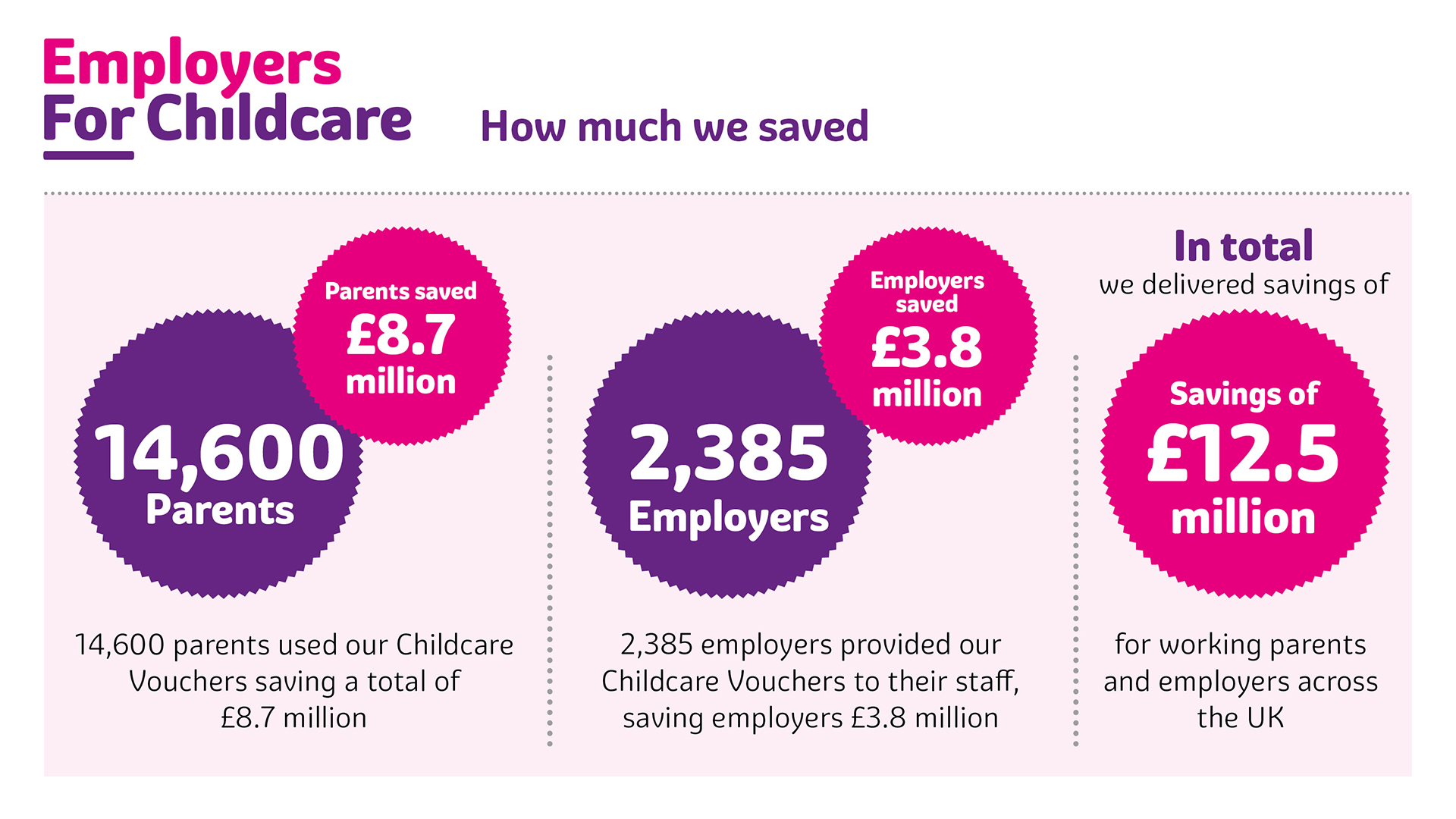

How Do Childcare Vouchers Work Employers For Childcare

Your Us Expat Tax Return And The Child Care Credit When Abroad

Download Teacher Salary Slip Excel Format Exceltemple Teacher Salary Teacher Help Free Resume Template Word

How To Take Advantage Of The Expanded Tax Credit For Child Care Costs

Tax Breaks To Pay For Private School

Can I Deduct Preschool Tuition

My First Piano Learn To Play Kids Parker Ben Amazon Co Uk Books

Your Us Expat Tax Return And The Child Care Credit When Abroad

Is Preschool Tax Deductible Canada Ictsd Org

Small Business Or Independent Contractor Income And Expense Etsy Business Tracker Independent Contractor Starting A Daycare

David John Marotta S Early Money Memories Memories Marotta Money

Child Care Tax Credits Can Help Families During The Coronavirus Pandemic Research Highlights Upjohn Institute

Is Preschool Tuition Tax Deductible Motherly

Canada Country Profile Career Advice Jobs Ac Uk